Understanding the Value of Gold: Why You Should Consider to Buy Gold

Gold has been a symbol of wealth and prosperity for centuries. From ancient civilizations to modern economies, gold remains a critical asset in any investment portfolio. In today’s volatile economic environment, the question arises: why should you buy gold? This comprehensive guide explores the myriad benefits of gold investment, market trends, and practical considerations for those looking to enter the precious metals market.

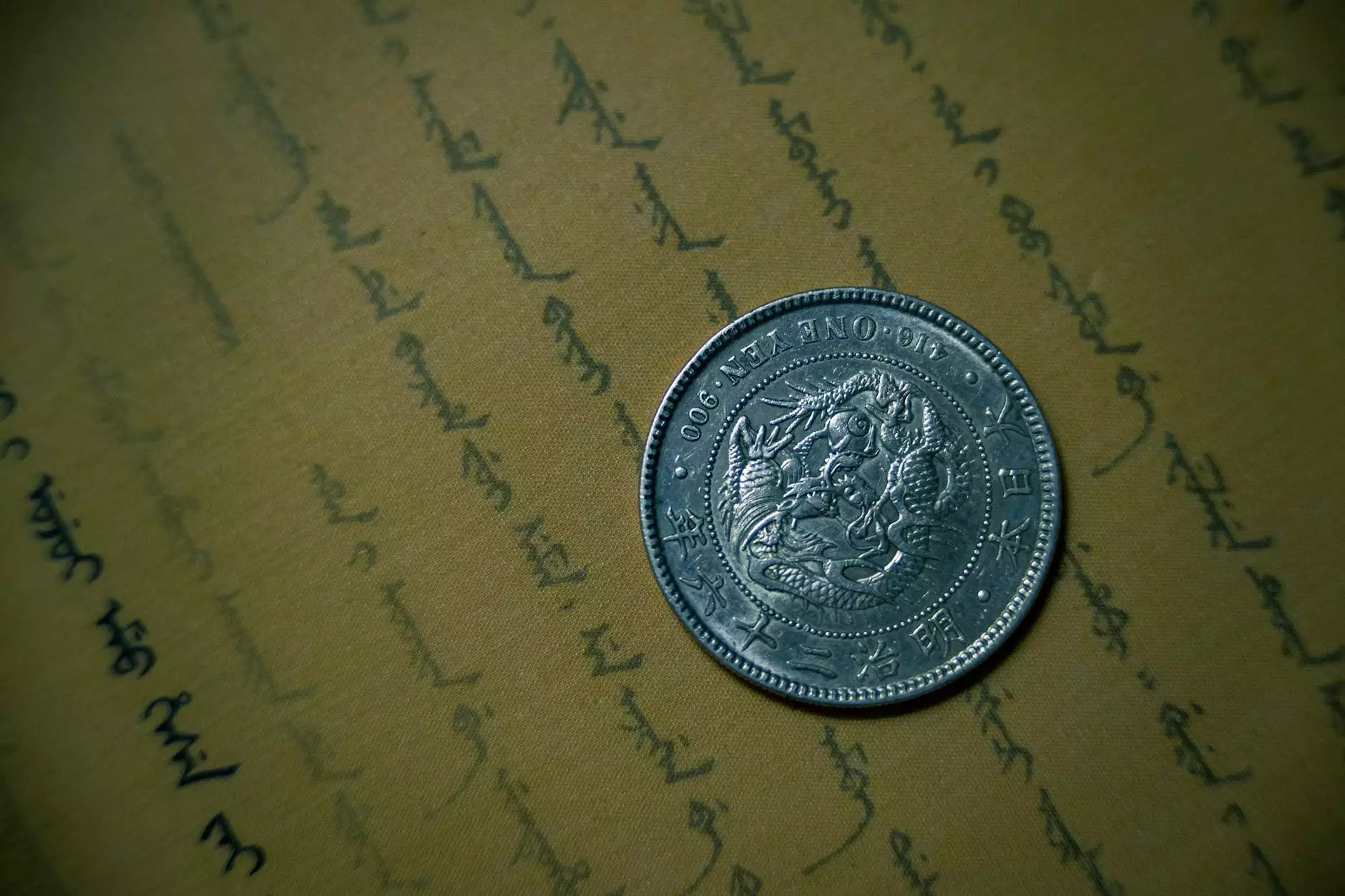

The Historical Significance of Gold

Historically, gold has played a significant role in human culture. It has been used for jewelry, currency, and even as a determination of social status. Ancient cultures, such as the Egyptians and the Romans, prized gold for its beauty and rarity. More importantly, gold has served as a reliable store of value throughout history, acting as a hedge against economic instability.

Benefits of Buying Gold

When contemplating whether to buy gold, consider the following benefits:

- Inflation Hedge: Gold tends to retain its value over time, making it a safeguard against inflation. As the cost of living rises, the value of gold often appreciates.

- Portfolio Diversification: Including gold in your investment portfolio reduces overall risk. The performance of gold typically has a low correlation to stocks and bonds.

- Global Acceptance: Gold is universally recognized and can be liquidated almost anywhere in the world, providing unparalleled flexibility.

- Safe Haven Asset: During geopolitical tensions and economic downturns, investors flock to gold, driving its price up and providing stability in uncertain times.

Gold Market Trends and Insights

The demand for gold varies based on several factors, including economic conditions, interest rates, and central bank policies. Understanding these trends can significantly impact your investment strategy.

Economic Indicators

Inflation rates, currency strength, and overall economic performance are crucial indicators of gold's market trends. When economies falter or inflation rises, demand for gold typically surges, making it an appealing investment.

Central Bank Activities

Central banks around the world continue to add gold to their reserves as a means of diversifying their holdings and protecting against currency fluctuations. Tracking these activities can provide insights into future gold prices.

Investor Sentiment

Market psychology plays a significant role in gold prices. Investor sentiment can lead to increased demand, affecting prices positively. Monitoring trends through news outlets and market reports can help you make informed decisions.

How to Buy Gold: A Step-by-Step Guide

Purchasing gold involves practical steps that ensure you make informed decisions. Here’s a detailed guide on how to buy gold:

Step 1: Determine Your Investment Goals

Before you buy gold, define your investment strategy. Are you looking for short-term gains or long-term security? Understanding your goals will guide your investment choices.

Step 2: Choose the Type of Gold

Gold comes in various forms, including:

- Gold Bullion: Physical gold bars or coins that carry intrinsic value based on weight and purity.

- Gold ETFs: Exchange-traded funds that allow you to invest in gold without owning the physical asset.

- Gold Mining Stocks: Investing in companies that mine gold can be a way to gain exposure to the gold market.

Step 3: Find a Reputable Dealer

Buying gold requires working with trustworthy dealers. Look for established companies with positive reviews. Websites like Dons Bullion provide a wealth of information and trusted services for purchasing precious metals.

Step 4: Understand the Pricing

The price of gold fluctuates daily based on market conditions. Before purchasing, familiarize yourself with the current gold price and how dealers price their products, typically including a premium over the spot price.

Step 5: Secure Storage Solutions

Once you've purchased gold, consider how you will store it safely. Options include:

- Home Safe: A secure home safe can provide convenient access, but comes with risks such as theft or loss.

- Bullion Banks: Keeping your gold in a bullion bank offers maximum security.

- Safe Deposit Boxes: Renting a safe deposit box in a bank provides a secure way to store your gold.

Gold vs. Other Precious Metals

While gold is the most famous of the precious metals, there are others worth considering. Comparing gold to silver, platinum, and palladium can provide a broader investment perspective.

Silver

Silver is often more affordable than gold, making it an attractive option for beginning investors. However, it can be more volatile due to its industrial uses.

Platinum

Platinum is rarer than gold and is commonly used in industrial applications like automotive catalysts. Its price can be affected by supply chain disruptions.

Palladium

Palladium prices have seen dramatic increases due to its use in automotive catalytic converters and limited mining output. However, it may not provide the same long-term stability as gold.

Common Mistakes to Avoid When Buying Gold

To maximize your investment in gold, avoid these common pitfalls:

- Not Doing Enough Research: Market knowledge is crucial in making informed decisions.

- Buying from Unverified Sellers: Always verify your dealer’s reputation to avoid scams.

- Ignoring Market Trends: Awareness of market conditions can help you make strategic timing decisions.

Conclusion: Elevate Your Investment Strategy by Buying Gold

In conclusion, buying gold can be a smart addition to your investment portfolio, offering stability, flexibility, and protection against economic uncertainties. By understanding the market dynamics and following the proper steps, you can navigate the world of precious metals confidently. For those ready to take the plunge, consider visiting Dons Bullion for expert guidance and quality products. With informed strategies and diligent research, you can unlock the potential of gold to secure your financial future.